Who Knew? Patients' Share Of Health Spending Is Shrinking

By Jay

Hancock

KHN Staff Writer

Jan 13, 2013 - Kaiser Health News

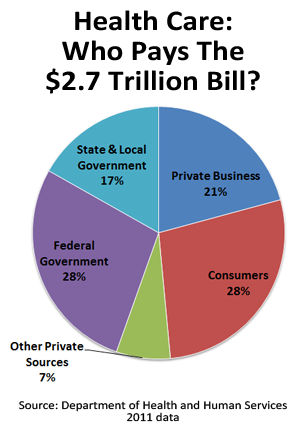

Consumer-driven medical spending may be the second-biggest story in health

care, after the Affordable Care Act. As employers give workers more "skin in the

game" through higher costs from purse and paycheck, the thinking goes, they'll

seek more efficient treatment and hold down overall spending.

But consumers may not have as much skin in the game as experts thought, new

government figures show.

Despite rapid growth in high-deductible health

plans and rising employee contributions for insurance premiums, consumers' share

of national health spending continued to fall in 2011, slipping to its lowest

level in decades.

"I'm surprised," says Jonathan Gruber, a health economist at the

Massachusetts Institute of Technology. "All the news is about the move to

high-deductible health plans. Based on that logic c I would have expected it to

go up."

True, medical costs are still pressuring families. Household health expense

has outpaced sluggish income growth in recent years, says Micah Hartman, a

statistician with the Department of Health and Human Services, which calculates

the spending data.

But from a wider perspective, consumer health costs continued a trend of at

least a quarter-century of taking up smaller and smaller parts of the

health-spending pie. Household expense did go up. But other medical spending

rose faster, especially for the government Medicare and Medicaid programs.

Economists measure three kinds of consumer health costs: insurance premiums

paid through payroll deductions or for individual policies; out-of-pocket costs

for deductibles and co-pays; and Medicare payroll taxes. Such outlays fell to

27.7 percent of the health care economy in 2011, down from 28 percent in 2010

and from 32 percent in 2000, according to the national health expenditures report issued by HHS last week.

That's in spite of the fact that one worker in three is covered by a plan

with a deductible of at least $1,000, up from one in 10 in 2006, according to the Kaiser Family Foundation. (KHN is an

editorially independent program of KFF.) Among small firms, half the workers are

now in high-deductible plans.

One factor holding down costs even for families with consumer plans has been

patent expirations for expensive, commonly used medicines such as Prevacid and

Flomax.

"People these days are spending a lot less out-of-pocket on prescription

drugs," said Peter Cunningham, director of quantitative research at the Center

for Studying Health System Change. "A lot of that has to do with the shift from

brand name to generics."

Nobody thinks consumer-driven medicine has run its course. Insurers and

employers are still building tools for patients to shop for care by comparing

costs for MRI scans, for example, or researching hospital quality records.

High-deductible plans are expected to win a large share of the business sold

next year through the health law's state insurance exchanges. Many companies say

they intend to offer high-deductible insurance -- especially plans with

tax-favored health savings accounts -- as the only option.

"I've heard of nothing but acceleration" of employers into consumer-directed

health insurance, said Roy Ramthun, a benefits consultant who was a senior

health policy advisor in President George W. Bushfs administration. "More local

units of government, school districts and even some union plans are starting to

move more aggressively into these areas."

High deductible plans are already getting credit for helping with an overall

slowdown in medical spending growth. Among other factors, economists suspect

that the prospect of higher wallet costs has made consumers even more likely

than usual to avoid doctor visits in the middle of a sluggish economy. (Public

health officials fear this will backfire with a later spike in illness.)

Sooner or later, householdsf share of the medical-cost pie will start to get

bigger, analysts say. The declines have been getting smaller, suggesting the

trend will reverse.

One reason is continued growth of high-deductible plans. Another is that,

starting in 2014, the health act requires individuals to start buying coverage

or pay a penalty. Another is that federal health spending has risen more than

three times as fast as consumer health spending since 2007, which canft

continue.

Even with recent tax increases on high-income households, the huge Medicare

program for seniors and the disabled is growing at an unsustainable pace, says

Joseph Antos, a health economist at the pro-markets American Enterprise

Institute. That means Medicare, too, will need to seek higher premiums,

deductibles or co-pays from the patientfs pocket, he said.

"Medicare is on a fiscal slide," he said. "Things are going to have to

happen. Eventually, whether you call it premium support or not, wefre going to

have to move to some kind of budgeted system in Medicare."

© 2013 Henry J. Kaiser Family Foundation. All rights reserved.